Injured Veterans Should Be Compensated With Something Permanent

Our nations vets should be compensated in Bitcoin and not dollars that can be taxed, inflated, and influenced. They secured our future, let's secure theirs.

Historically speaking nations would incentivize/reward those who did something extraordinary with something permanent like a deed to a plot of land or gold, and now we have the technology to do the same, to compensate our heroes in digital gold.

Today, government money is controlled and subverted in a such a way that it steals the value of our dollars slowly over time. Rewarding and compensating our hero’s in Canadian dollars is unethical. Inflation, censorship, and reserve banking create a nefarious monetary system. We should all be saving our wealth in sovereign, sound money. And we should be compensating our injured veterans accordingly— using Bitcoin.

There are many good people working in Veterans Affairs Canada (VAC) on supporting our veterans and compensating them accordingly. And like most government departments I’m sure they could do a better job, this is not an indictment of VAC (I’m sure you can find many such critics online). But a suggestion to vastly improve the effects of whichever compensations or support programs the government, or future governments, decide to give to our vets.

Lets take a hypothetical injured Afghanistan veteran, we’ll call him Jeff, and use his potential compensation from VAC to illustrate how by paying Jeff in Canadian dollars we’re actually not providing him with the proper financial security and compensation for his sacrifices.

For the sake of argument let’s suppose Jeff lost both his legs in Afghanistan. Not unheard of in a theatre of war with IED’s and booby traps. Without diving too much into the details and convoluted nature of VAC’s compensation program, Jeff would be eligible for a ‘Critical Injury Benefit’ as well as ‘Pain and Suffering Compensation’ to “address the immediate impacts of the most severe and traumatic service-related injuries or diseases sustained.”

According to Veterans Affairs (In today’s dollars) Jeff will receive $87,992.30 from the Critical Injury Benefit, and $264,595.18 for Pain and Suffering (60% injury) if he chooses to take the lump-sum payment instead of a monthly allowance. He’ll also most likely be eligible for education grants as well as other benefits but roughly speaking he will receive about $352,587.48 Canadian dollars.

At first glance this might seem okay, but there’s one slight problem. A sinister one that’s a little bit hard to see and it’s slowly sucking the value out of all of our wallets. Inflation. The slow, and sometimes fast, increase in the money supply and total debt of our country erodes the purchasing power of our currency. Purchasing power is the term used to be able to afford equal goods and services over time. And the lack of the Canadian dollar to be able to hold its purchasing power over time is the reason why your parents could buy a home for a fraction of their income but your children will most likely not be able to afford one.

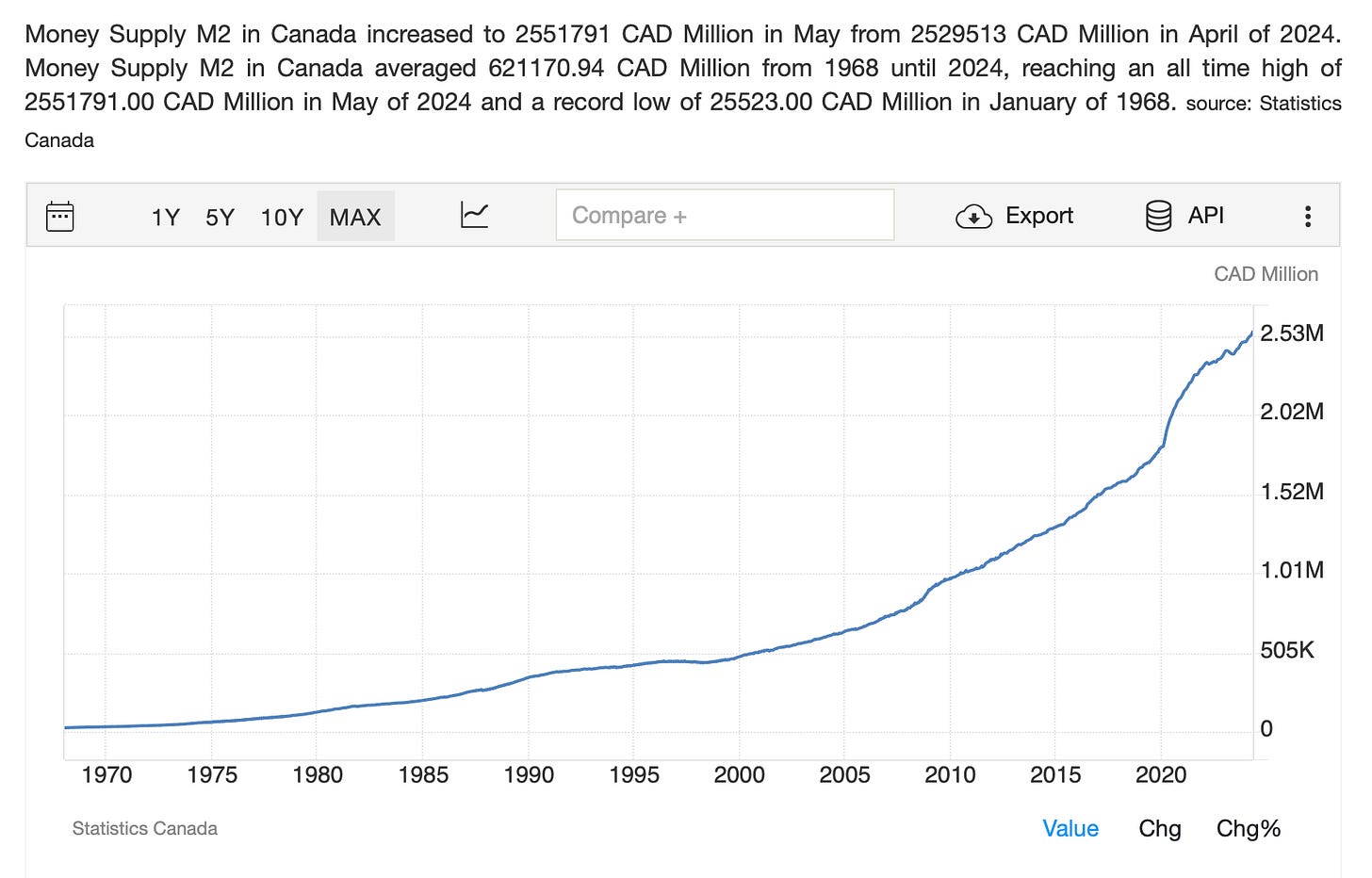

Canada uses the Bank of Canada to increase the money supply of Canadian dollars every year (They’re not required to do this but seemed to have been convinced that it’s a good idea). The so called ‘printing of money’ isn’t exactly printing but the usage of issuing new debt and other monetary instruments to pay for things we likewise wouldn't be able to afford; like Covid relief cheques. This is all well and good I suppose but we never seem to pay the debt off. And the more serious problem is that it creates an increasing money supply in our currency thereby devaluing the money in your pocket and in your bank account.

Above: The amount of Canadian dollars in circulation.

How is the average Canadian supposed to save his or her hard earned money if they keep dumping truckloads more into the pile? This is inflation. This is why gas and groceries cost more. Not climate change. Not some mysterious force.

As Jeff returns from Afghanistan and is released from the military (due to the fact he no longer has any legs), he’ll have his cool crisp $352k in the bank. Enough for a down payment on a house, and a big chunk he can put into his savings or investment fund for his retirement or to subsidize his income. But Jeff is like most Canadians, he’s not a stock trader, he just wants to put his hard earned money and compensation into a savings account and use it later.

But unfortunately for Jeff the Bank of Canada’s money printing doesn’t slow down. And he’ll need to find ways to make even more money to keep up with the costs of goods and services as he gets older. Markedly harder with someone with no legs. This is why more and more people are not sure about retirement. The good ol’ pension doesn’t go as far as it used to and more and more seniors in Canada find themselves working again and or living just above the poverty line.

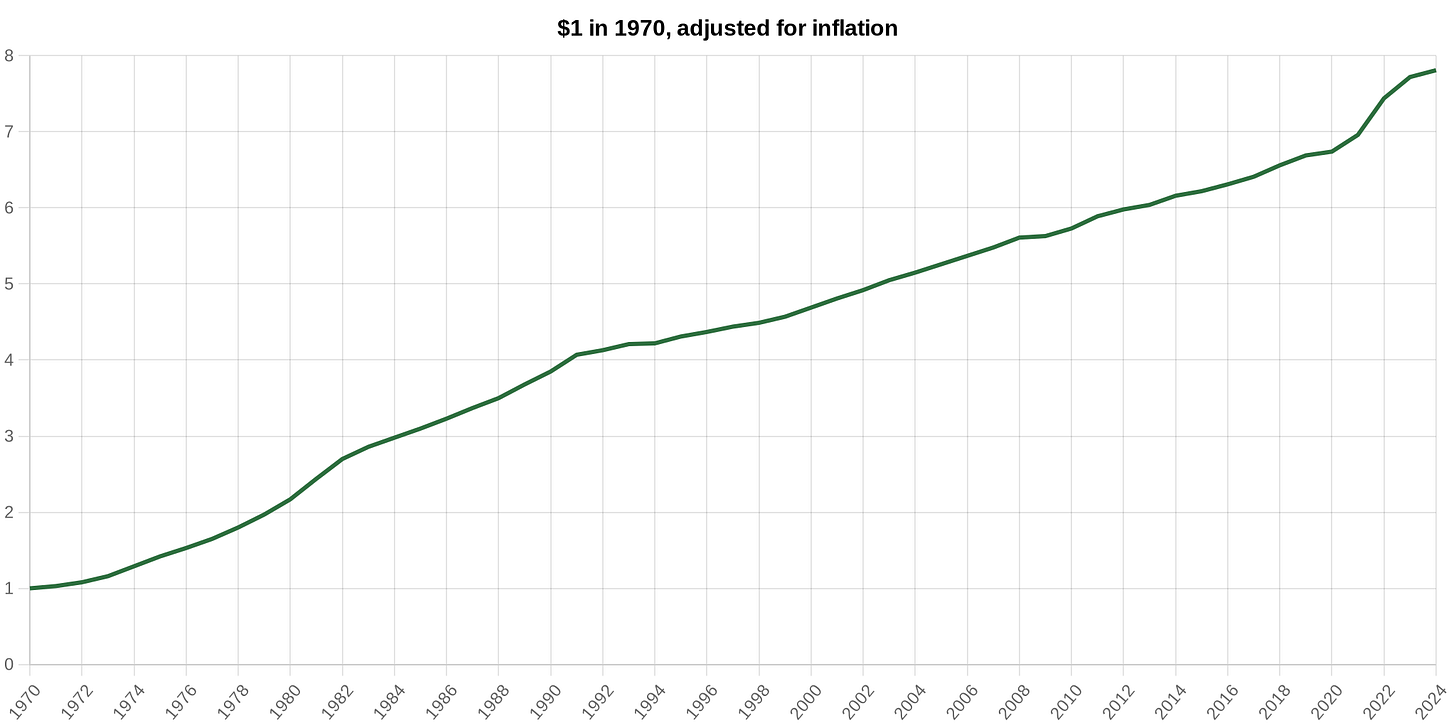

Above: The loss of purchasing power in $CAD since 1970.

In 2024 you’ll need to have $8 to purchase what $1 did in 1970. This is a serious loss in purchasing power, the effect of inflating the money supply.

“Inflation erodes the purchasing power of money. Even with a low annual inflation rate of

2 per cent (the midpoint of the Bank of Canada’s 1 to 3 per cent target range for inflation since 1995), a dollar will lose half of its purchasing power in approximately 35 years.”

BANK OF CANADA

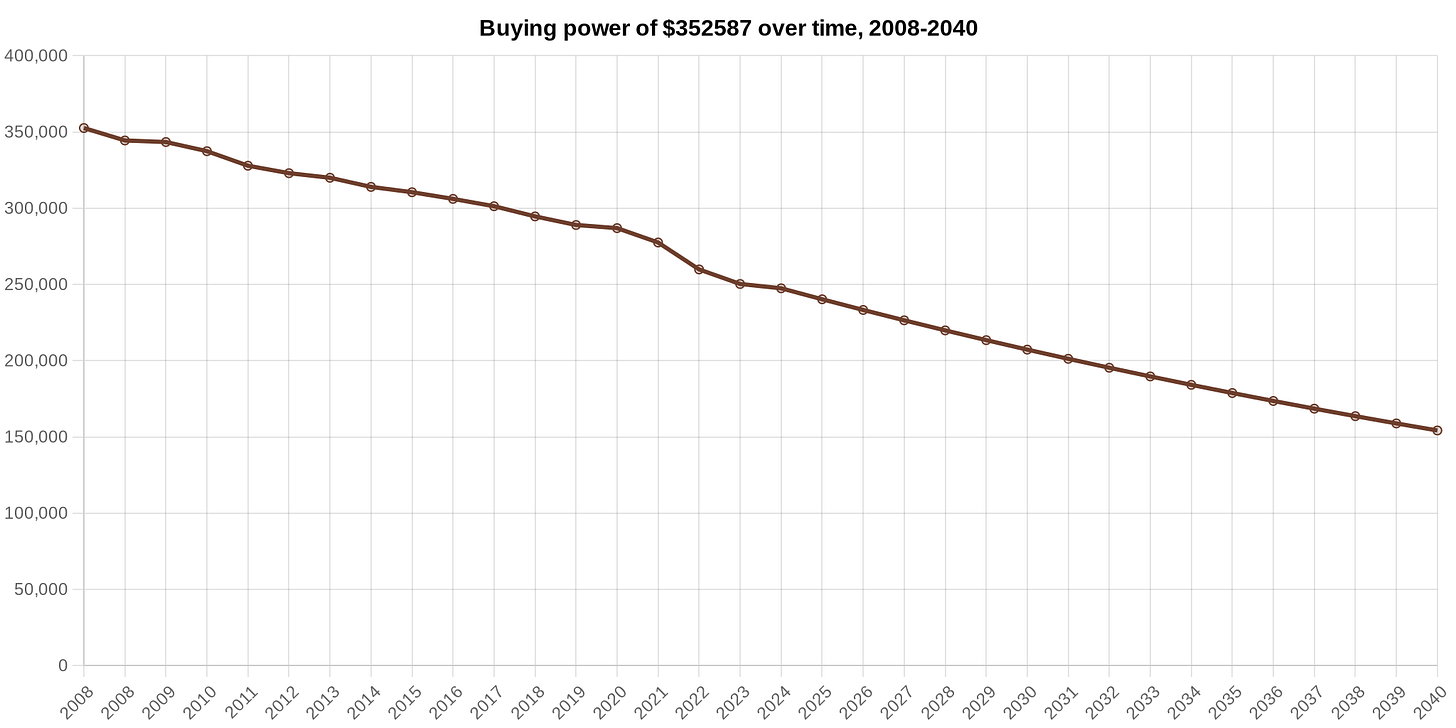

Let’s say Jeff was injured and released from the CAF in 2008. And if the rate of inflation continues around 2-3%, for Jeff to be able to use his compensation to buy the things he needs (the same things he needs in 2008) in the future he’ll need to have around $800,000 CAD. He’s going to lose at least half, if not more, of the purchasing power of his compensation as he ages.

Above: The loss of Jeff’s compensation package’s purchasing power due to inflation.

If Jeff just saves his money in a box under his bed, it’ll only be worth $150k of purchasing power (almost half) when he is in his 50’s or 60’s. Our money should work in the reverse fashion. Like Bitcoin.

Jeff should be compensated in sound money. Something the Government (blue, red or orange— doesn’t matter) can’t dilute, change, or influence. Gold is difficult to transfer and would be impractical for Jeff. And giving out free land is out of the question. So that leaves only one thing. Digital gold— Bitcoin.

Average home prices in Canada (CAD / BTC):

2018: $488,862 — 91 Bitcoin

2019: $502,811 — 45 Bitcoin

2020: $567,332 — 30 Bitcoin

2021: $688,096 — 12.5 Bitcoin

2022: $703,875 — 17.5 Bitcoin

2023: $678,282 — 13 Bitcoin

2024: $694,173 — 7.5 Bitcoin

2025 (projected): $722,063 — 3.5 Bitcoin

Sources: Statista.com, Yahoo Finance

Jeff and many other Canadians are saving in the wrong medium. The value of your stored energy should go up over time, not down.

There will only ever be 21 Million Bitcoin. Mathematically certain and physically impossible to change. Compensating Jeff and other veterans in Bitcoin— or teaching and guiding them to use their compensation and retirement packages to store Bitcoin for their future is the only way to properly compensate them in a way that is permanent. In a way that is moral and will allow them to have a prosperous future and recover from their injuries sustained in service to our country.

It also protects their compensation from any future government robbing them of their wealth with the printing of money for the next pandemic, social handout, or whatever ‘emergency’ said future government says is so important we need to artificially create more money; and thus robbing Jeff, all other injured veterans, us, and most importantly— our children.

Bitcoin is sovereign, digital, sound money. It’s the best monetary asset to hold and store your wealth and savings over time. Gold was great for the last 5000 years but gold can’t be sent over the internet, carried in your pocket (or mind), and its supply increases about 1-2% every year. With Bitcoin your money and value is secured, forever. And what’s more, you can self custody it. So no politician or CEO can change or remove your right to own and use your Bitcoin based on your actions or beliefs.

If you’re a veteran I highly encourage you to read and learn about Bitcoin. If you have been injured or will soon retire, taking a few days (yes it will take time) to learn about Bitcoin and how you can properly store your value for the long term can be life changing.

You’re speaking my language. The best quote I’d heard was BTC is an IQ test. Once you understand it, you can’t go back.